TIWN

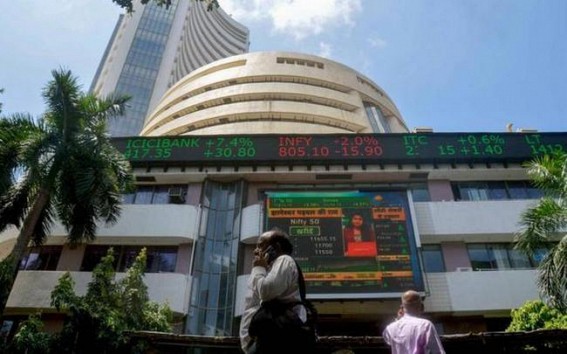

Mumbai, Dec 9 (TIWN) Macro-economic data points along with the direction of foreign fund flows and US Fed's monetary policy are expected to influence the Indian equity market's trajectory next week, analysts opined.

Additionally, the rupee''s movement against the American dollar and the progress of US-China trade deal as well as crude oil price fluctuations will impact investors'' risk-taking appetite. "The major trend which is developing is a rally in the commodity markets, especially metals. The US dollar has begun to see overhead supply, EU economic data is improving. A phase 1 US-China trade deal and dovish US Fed may make this trend more visible," Edelweiss Professional Investor Research''s Chief Market Strategist Sahil Kapoor told IANS. "As suggested earlier, Nifty has entered a consolidation phase which played out last week. It now seems that fresh upmove may begin as we enter deeper into December month." In terms of macro-data, investors will look forward to the release of industrial production, retail and wholesale inflation figures next week. These data points hold significance as the Reserve Bank in its last monetary policy kept lending rates intact thereby prioritising rising inflation over grim economic growth.

- India’s industrial growth at 3.5 pc in July signals healthy recovery: Economists

- AI to unlock $500 billion opportunity for India’s tech services: Report

- India’s credit rating upgrade to boost investors’ confidence, drive foreign capital inflows

- Centre to update WPI, IIP; announces launch of new Producer Price Index

- S&P Rating's growth projection for India is no surprise: SBI Research