TIWN

Mumbai, Aug 25 (TIWN) With the government announcing a slew of measures to boost the economy, a JM Financial report has suggested that although the government has been responsive to the issues of industry, the steps may not be sufficient and more measures might be needed to give a fresh start to the lending cycle of non-banking financial companies (NBFCs).

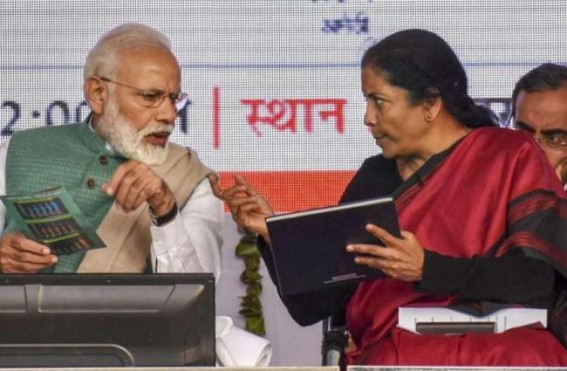

"In our view, while the specifics matter, it was equally important to note that the government is not turning a blind eye to the slowdown and to suggestions from the industry. "The specifics, on the other hand, while broadbased, may not be sufficient to create a virtuous cycle of demand recovery given that the level of pessimism is extremely high, that more is required to lower the real estate inventory and to restart the cycle of lending by the NBFCs," said the report on the latest measures announced by finance minister Nirmala Sitharaman.

- India’s industrial growth at 3.5 pc in July signals healthy recovery: Economists

- AI to unlock $500 billion opportunity for India’s tech services: Report

- India’s credit rating upgrade to boost investors’ confidence, drive foreign capital inflows

- Centre to update WPI, IIP; announces launch of new Producer Price Index

- S&P Rating's growth projection for India is no surprise: SBI Research